The free-agent market has already started to heat up for the upcoming winter meetings in the “honky-tonk” heartland of Nashville.

Some high profile pitchers have already agreed to contracts in excess of $738 million.

None have been bigger up to this point than David Price’s deal at $217 million over seven years.

With MLB expecting to eclipse the $9.5 billion revenue mark in 2016, more franchises are willing to jump into the deep end of the pool.

Interestingly enough, some of the usual free spenders have stood on the side lines up to this point and have made way for some unusual suspects.

One of the biggest surprises so far has been the signing of Zack Greinke by the Arizona Diamondbacks.

The deal is valued at $206.5 million over the next six years which equates to an approximate average annual value of $34.4 million per year.

Even though David Price’s total contract amount with the Red Sox is $11 million more, Greinke’s AAV is roughly $3.4 million more per year.

With the combined collaborative front-office effort of Chief Baseball Officer, Tony LaRussa and GM Dave Stewart, it’s been made apparently clear that claims have been staked in the desert sand. The “wild” NL West is on notice in 2016.

So, as teams become more analytically aware of current player value and future performance, win projections often influence a club’s free agent decisions.

With that said, who has the better value, Greinke or Price?

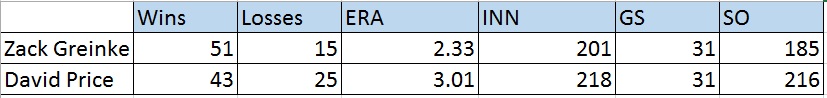

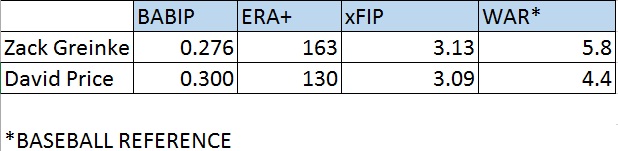

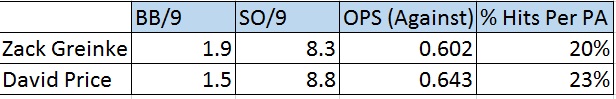

Let’s first look at their seasonal average performance numbers encompassing the last three seasons. Based upon the traditional statistics, here’s the tale of the tape:

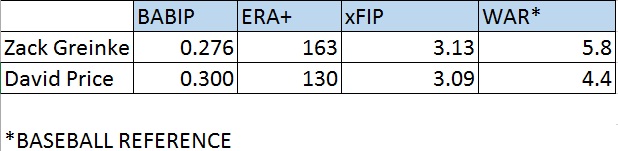

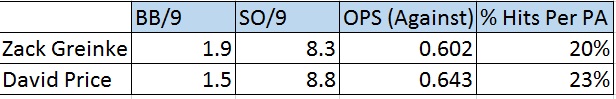

By looking at the above listed numbers, it appears as though Greinke has a strong edge in most categories, but Price had a slight edge regarding the average walks and strikeout per 9 innings.

This, in all likelihood played a role in the lower xFIP. Also, the new Red Sox left-hander has averaged 17 more innings per season.

Anyway, it’s been stated by baseball insiders that one win above replacement for a playoff contending team that hovers around the 89-90 win threshold is worth between $7 to $9 million.

That’s assuming that the team is competing in a big-market. Whereas, a small to mid-market club values a win between $4 to $6 million. With that said, the Arizona Diamondbacks approximate $1.5 billion broadcasting rights deal encompassing the next 20 years makes this mid-market club a potential big-market player.

This becomes even more compelling because the Arizona franchise now has more financial freedom to upgrade their on-field personnel as range of viewership expands exponentially.

Finally, if we take into consideration the average seasonal difference in WAR, the newly minted Diamondback has a $9.8 million advantage over his fellow hurler.

Using the low end of the big-market spectrum, this roughly translates into about $40.6 million in value per season to have Greinke on the bump versus David Price’s

$30.8 million. Granted, there are other variables to consider regarding future performance of these two aces, but in my opinion, the above analysis suggests that “The Price is Right” for Zack Greinke.

References:

1. "Baseball Statistics and Analysis | FanGraphs Baseball." Baseball Statistics and Analysis | FanGraphs Baseball. Fangraphs, n.d. Web. 7 DEC. 2015.

2. "Baseball Reference." Baseball-Reference.com. Baseball Reference, n.d. Web. 7 DEC. 2015.

NOTE: All statistics accurate as of 12/7/15

By Vincent Scotto

AriBall.com